Despite US Sanctions, Large-Scale Belt and Road Initiative Project in Cambodia Forges Ahead

Editor’s Note: To read the entire analysis with footnotes, click here to download the report as a PDF.

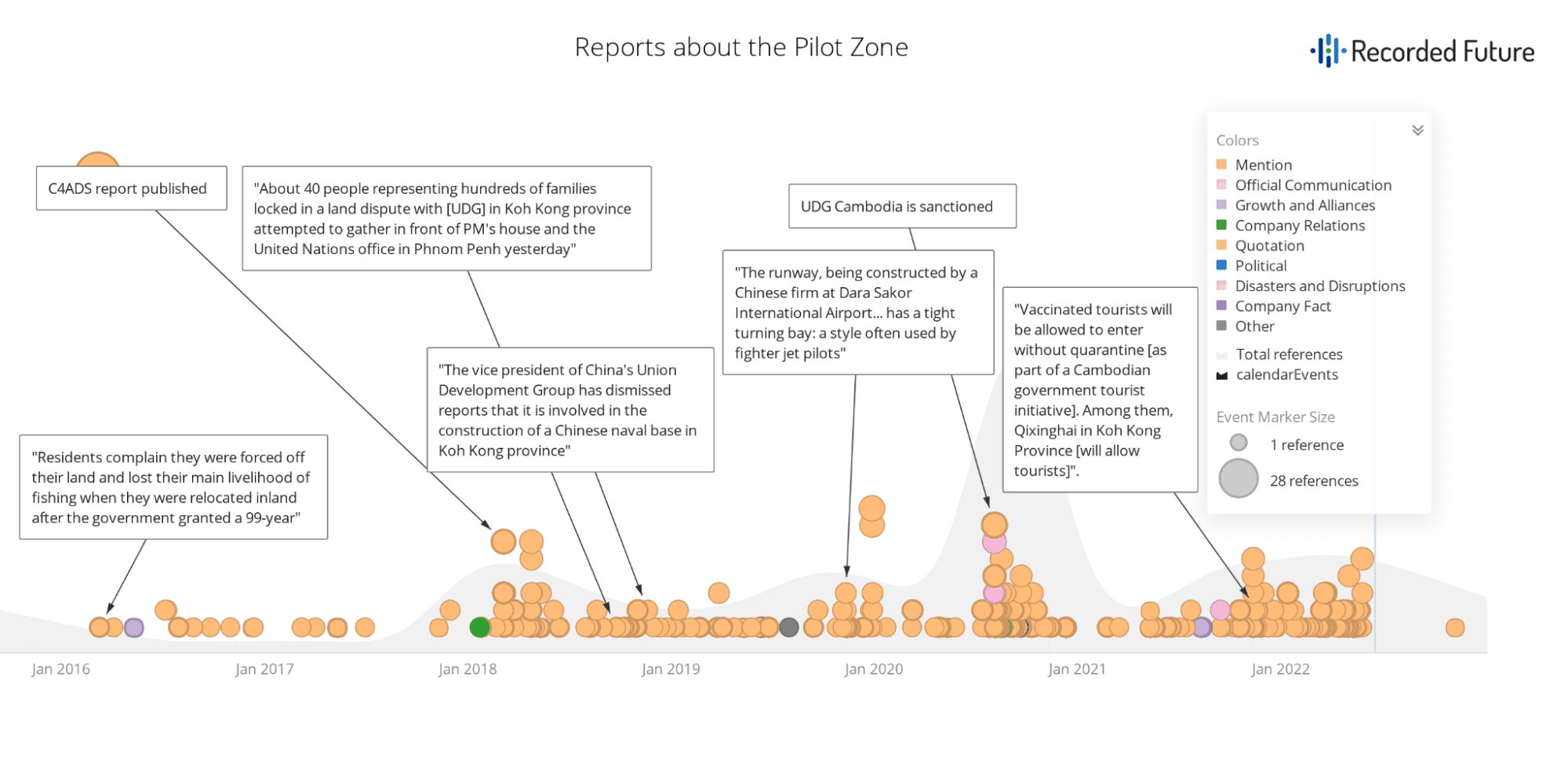

This report uses the Recorded Future Platform, satellite imagery, Chinese and Cambodian news sources, corporate records, and other publicly available information to assess progress on a Belt and Road Initiative (BRI) project in Cambodia that is led by a United States (US)-sanctioned company. This report specifically focuses on the development of this project since early 2018, when a report by the Center for Advanced Defense Studies (C4ADS) documented its then-current state, and since September 2020, when the US sanctioned the developer. This report will be of most interest to policymakers, journalists, and researchers interested in understanding developments along the BRI, China-led development in Cambodia, and the effects of American sanctions. Information about the author, Devin Thorne, can be found at the end of this report.

Executive Summary

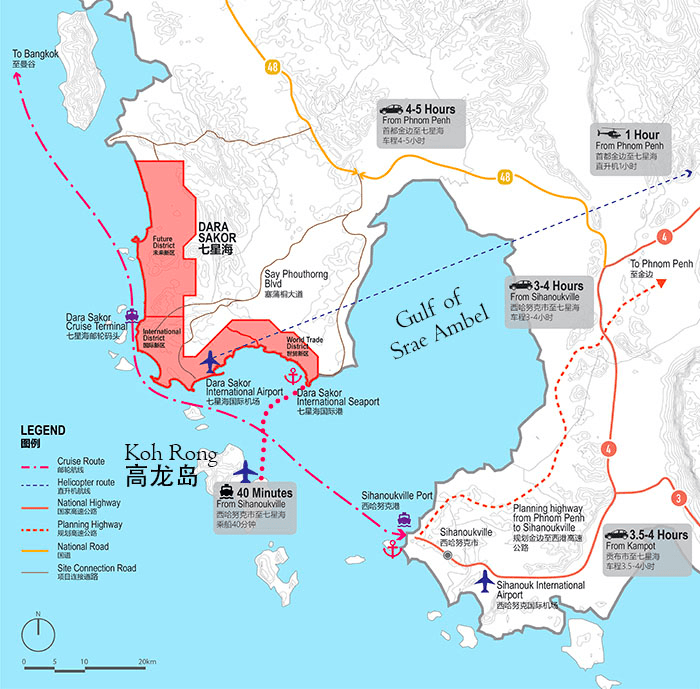

US sanctions have failed to stop the development of new tourist facilities, basic infrastructure, and an international airport in a large-scale Belt and Road Initiative project in Cambodia. The project, known as the Cambodia–China Comprehensive Investment and Development Pilot Zone and Dara Sakor Seashore Resort (柬中综合投资开发试验区暨柬埔寨七星海旅游度假特区; hereafter, the Pilot Zone), began in 2008 and became part of the Belt and Road Initiative in 2016. The Pilot Zone was originally led by the now-sanctioned Cambodia-based project lead, Union Development Group (UDG Cambodia; 优联发展集团有限公司; យូញៀន ឌីវេឡុបមេន គ្រុប ខូ អិលធីឌី), a close affiliate or subsidiary of China-based developer Tianjin Union Development Group (UDG Tianjin; 天津优联投资发展集团有限公司). Yet, in spite of US sanctions, development continues under a new company created in 2018 amid rising negative press and under new branding adopted after UDG Cambodia was sanctioned in late 2020. The new company and brand are almost certainly still closely linked to the original developers.

Around the time when UDG Cambodia was sanctioned, a major concern expressed by the US Treasury Department and other parts of the US government was the potential of the project to host Chinese military assets or even become a military base. There is no specific evidence the Pilot Zone is being shaped for military purposes and not even the first of 3 planned ports that could support Chinese warships is completed, making it unlikely to have such a function in the near future. However, China uses commercial ports and port-city projects developed by Chinese companies to project naval power far from China’s shores. Given the Pilot Zone’s broad scope — including tourist resorts, industry parks, medical facilities, and ports and an international airport large enough to accommodate military assets — and 99-year development timeline, it is prudent to monitor the project’s continuing progress.

Key Judgments

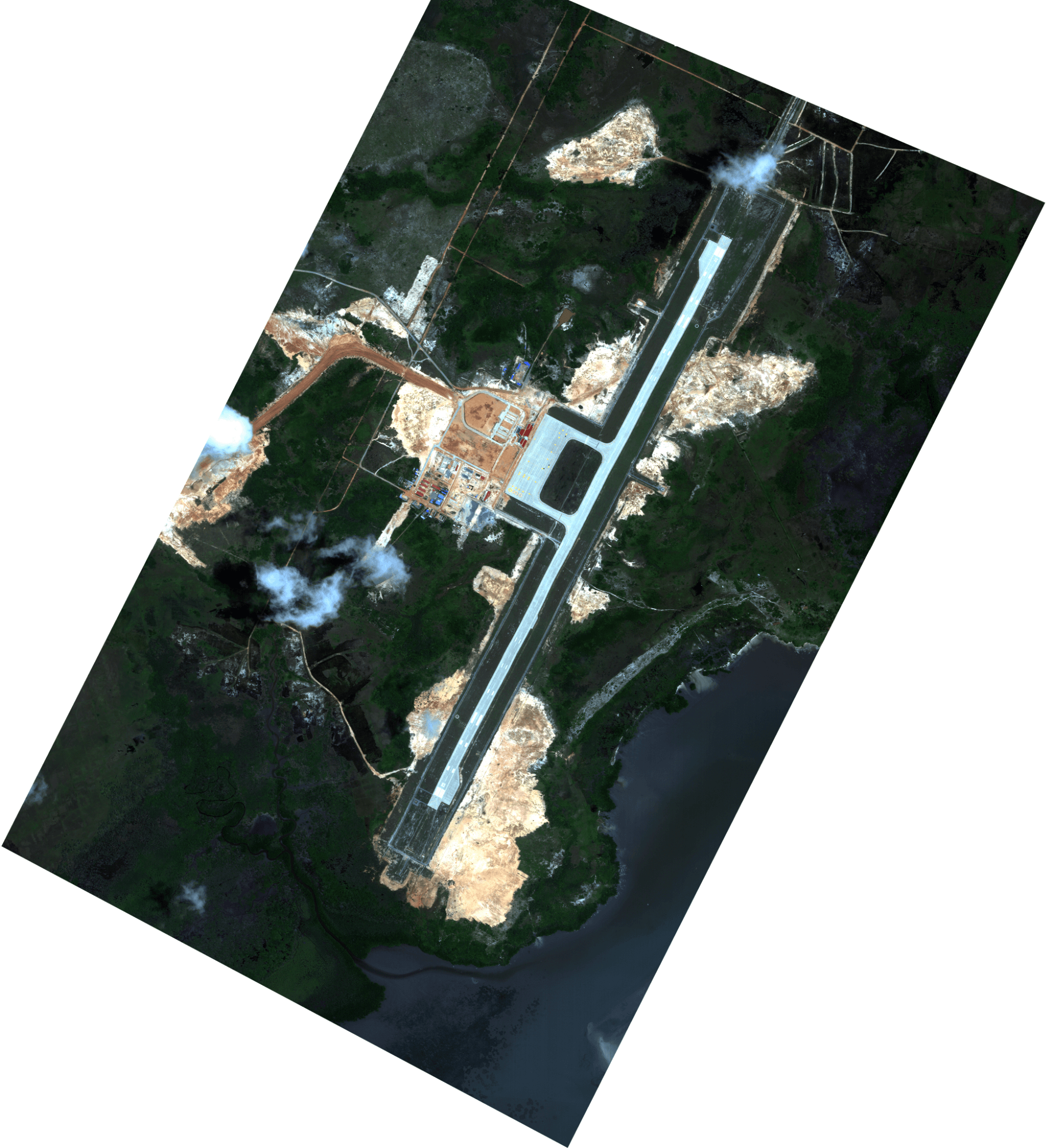

- Despite US sanctions, construction and other forms of development continue within the Pilot Zone, particularly at tourist attractions such as new shopping districts and the Dara Sakor International Airport.

- Since early 2018, development in the zone has also focused on basic infrastructure such as establishing power and telecommunications and setting up partnerships to advance the non-tourism aspects of the Pilot Zone.

- In addition to a 10,000-ton pier (port) for cruise liners and commercial goods that is said to be completed (though it almost certainly is not), plans for the Pilot Zone now include 2 additional ports, 1 of which will reportedly accommodate 100,000-ton vessels.

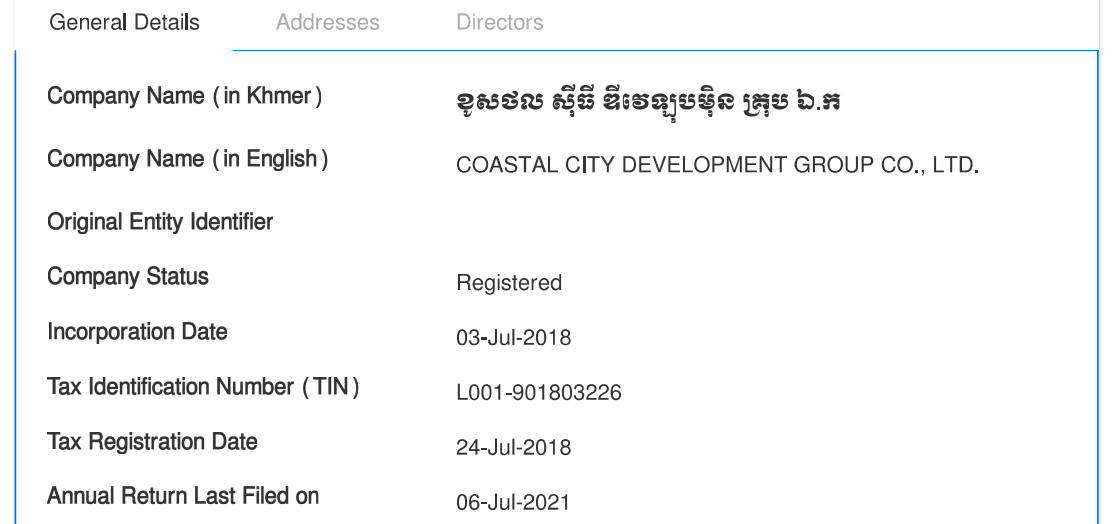

- In mid-2018, a new company in the UDG family was created and now likely leads development of the Pilot Zone; originally called Union City Development Group Co. Ltd., this company adopted a new name — Coastal City Development Group Co. — after UDG Cambodia was sanctioned.

- Although the Pilot Zone is not overtly designed to provide logistical support to China’s military, this potential cannot be dismissed as Chinese analysts continue espousing the use of commercial port and port-city developments to facilitate China’s power projection.

A Controversial Project

Sanctions and Corruption

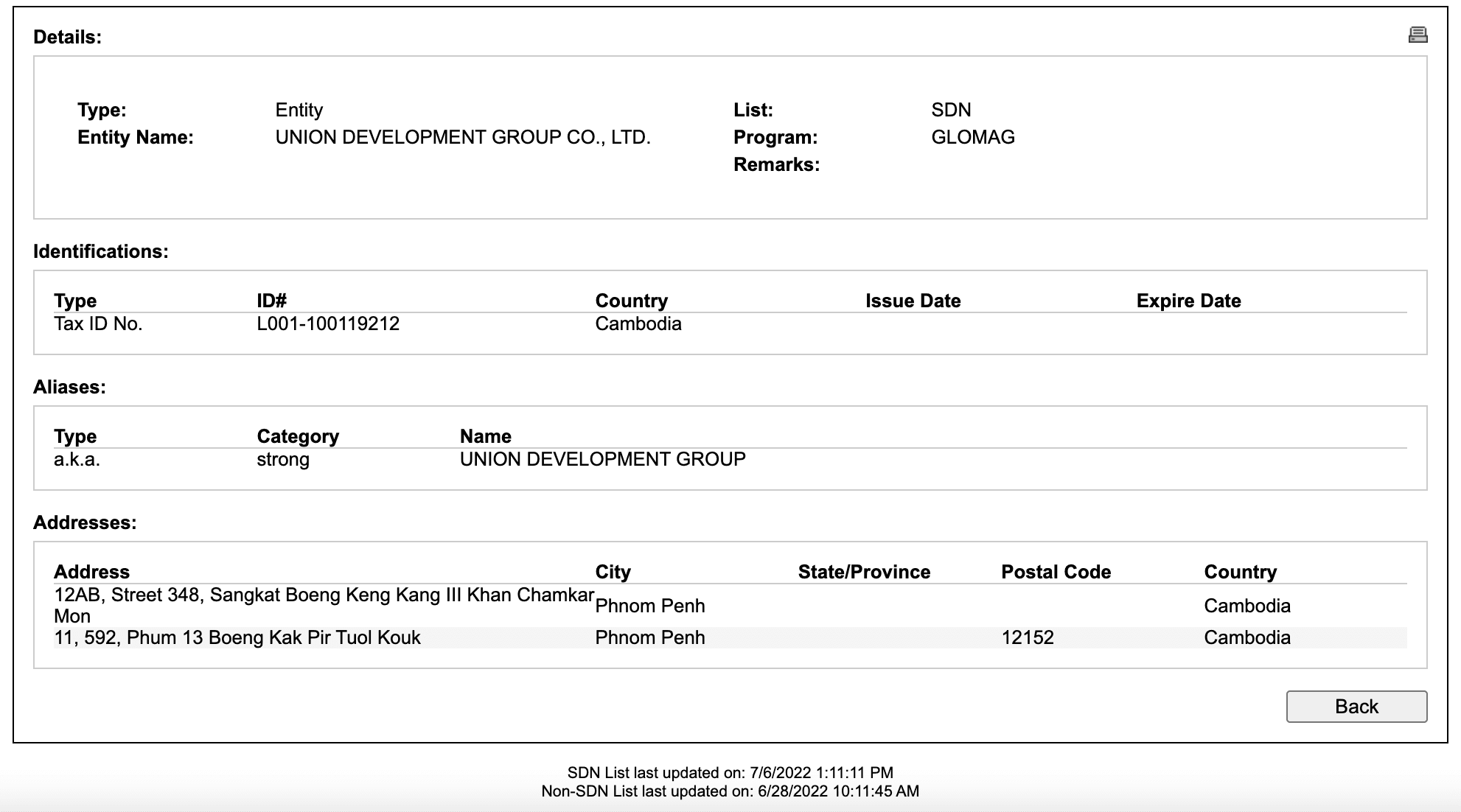

From the size of the land concession on which it sits, to the developer’s treatment of local residents, to environmental concerns, the Pilot Zone has been stalked by controversy for over a decade. At 45,100 hectares, the Pilot Zone constitutes 20% of Cambodia’s coastline and is 4.5 times the legal size of economic land concessions in Cambodia. Cambodian officials and international human rights bodies have expressed concern about land disputes with Cambodians living in the zone. The US Treasury Department sanctioned project developer UDG Cambodia in September 2020 under the Global Magnitsky Human Rights Accountability Act, though some analysts argue this was primarily motivated by a desire to punish Cambodia for strategic alignment with China rather than concern about human rights. Regardless, the company remains sanctioned today (see Figure 2).

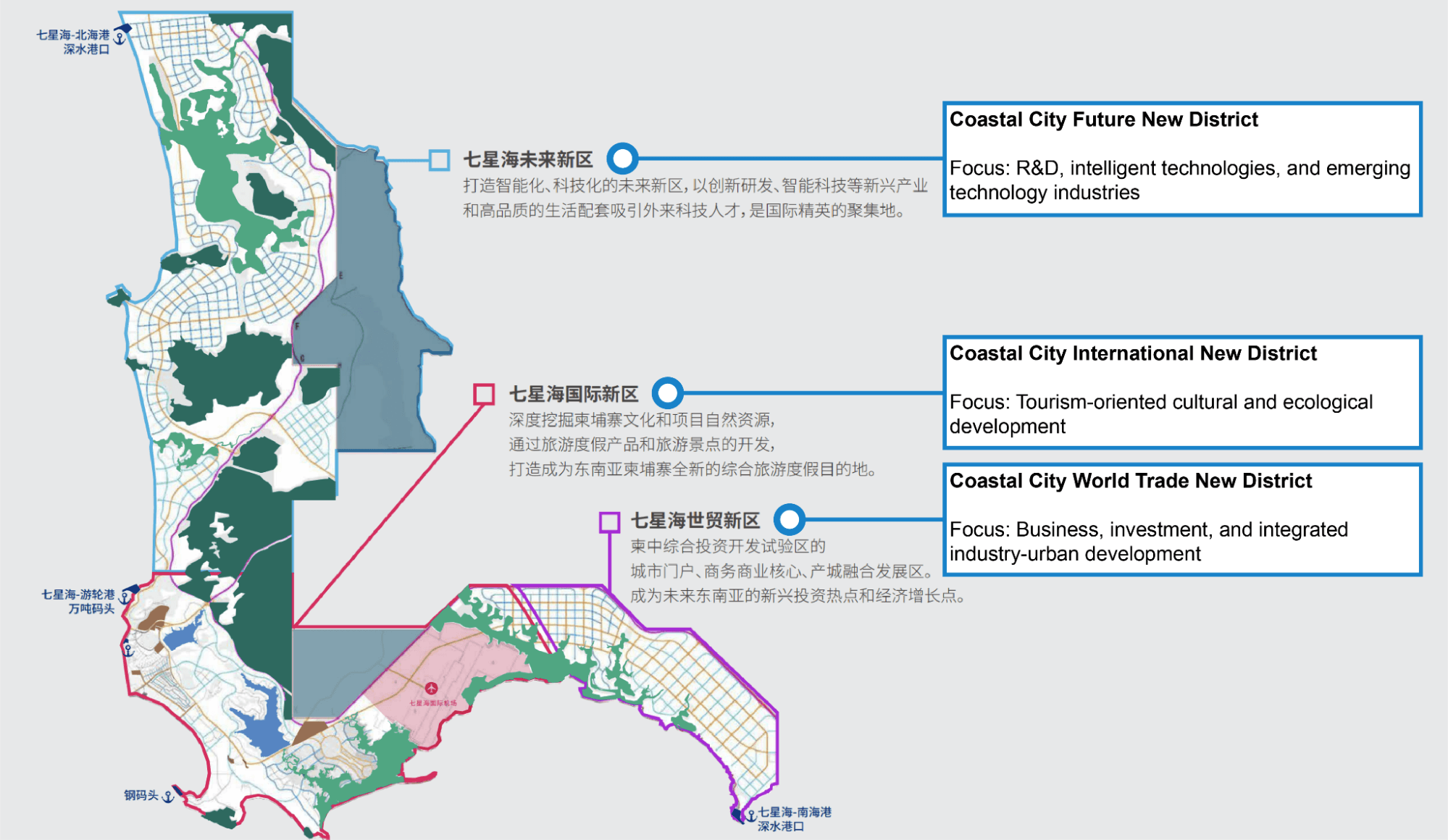

Figure 1: The Pilot Zone and surrounding transport corridors (Source: BeyondRealty Asia)

Figure 2: UDG Cambodia listed in the Specially Designated Nationals and Blocked Persons list administered by the Office of Foreign Assets Control of the US Treasury Department, accessed July 2022 (Source: OFAC)

Cambodian law limits economic land concessions to 10,000 hectares and stipulates that “the same person or legal entity cannot hold several concessions that total more than 10,000 hectares”. Moreover, economic land concessions are only supposed to be granted from “state private land”. The Pilot Zone’s creation circumvented both of these requirements. Not only is the zone overlarge, it includes a portion of Cambodia’s Botum Sakor National Park that was converted into concession-eligible land by a royal decree. Some sources say the entirety of the original 36,000 hectares was carved from Botum Sakor National Park, driving concerns about deforestation in relation to the Pilot Zone’s development.

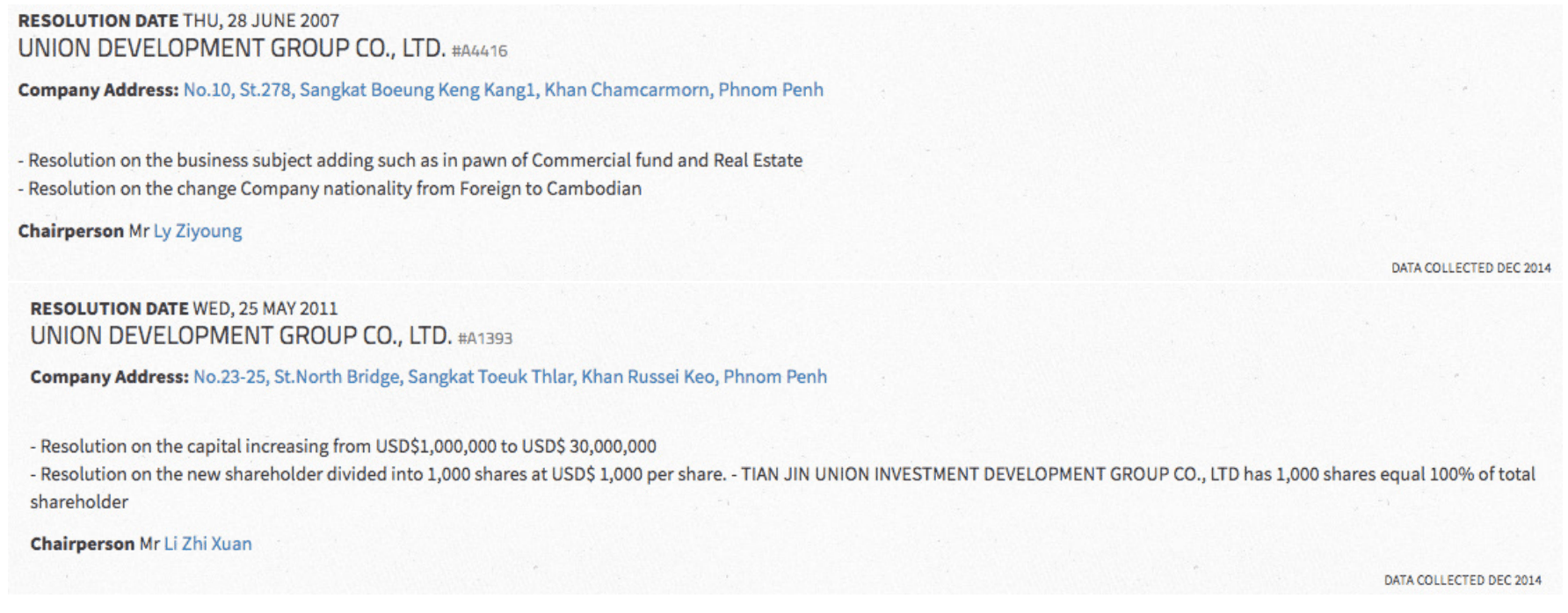

How UDG Tianjin and UDG Cambodia managed to secure an economic land concession flouting both of the restrictions discussed above is unclear. When the US Treasury Department sanctioned UDG Cambodia, it asserted the company had manipulated its corporate identity as described above to acquire the Pilot Zone’s land. This manipulation was first documented in a public report by former C4ADS analysts Devin Thorne and Ben Spevack. Using Cambodian corporate records, they showed how UDG Cambodia was initially registered as a foreign-owned Chinese firm but changed its status to that of a domestic Cambodian firm 1 year prior to signing the Pilot Zone’s lease agreement with the Cambodian government. After the lease agreement was concluded, UDG Cambodia issued 1,000 shares valued at $1,000 USD each. All of these were purchased by UDG Tianjin in China. UDG Cambodia’s chairperson at the time, a Cambodian national, was also replaced by a Chinese national with ties to UDG Tianjin’s parent company. However, Thorne and Spevack noted that the purpose of this manipulation was unclear, given that there is no exception for Cambodian-owned businesses regarding the 10,000-hectare limit on economic land concessions.

Figure 3: Changes to the corporate record of UDG Cambodia (Source: C4ADS)

In 2012, a report submitted to the United Nations General Assembly (UNGA) on the human rights situation in Cambodia by a Special Rapporteur on the situation of human rights in Cambodia expressed concern over treatment of local citizens living within the Pilot Zone. It documents the relocation of approximately 1,000 families and the struggles they faced after relocation, including limited options for generating income and poor compensation for their repurposed land. It states that UDG Cambodia hired guards to control access to villages from which some residents refused to relocate. In 2015, such guards reportedly burned crops and homes built by people on seemingly unused land. As late as 2017, the company reportedly constructed fences around properties owned by a small number of residents still resisting relocation. In 2019, the representatives of 140 displaced families protested outside of the Chinese Embassy, requesting promised compensation that they reportedly had yet to receive. As of October 2021, some Cambodian families were still refusing compensation for their land, believing the compensation amounts to be unfair. In November 2021, more than 1,000 families agreed to a compensation package, but some continued to express dissatisfaction.

The US Treasury Department’s press release announcing sanctions on UDG Cambodia further asserted the company “used Cambodian military forces to intimidate local villagers and to clear out land necessary for” developing the Pilot Zone. These military forces and UDG Cambodia reportedly used violent means, despite calls by the Cambodian Council of Ministers and United Nations Office of the High Commissioner for Human Rights for the company to stop such activities. The US Treasury Department’s announcement further asserts that use of Cambodian military personnel was arranged through General Kun Kim, a former high-ranking military leader who has also been sanctioned by the US government. Both the 2012 report to the UNGA and US Treasury Department’s press release also mention concerns regarding environmental degradation caused, or that could be caused, by the Pilot Zone’s development.

Potential Military Use

A recurring question posed by foreign analysts, news media, C4ADS’s report, and the US government related to the Pilot Zone is whether it could host Chinese military assets in the future or otherwise support China’s military activities in Southeast Asia. There is no specific evidence that the Pilot Zone is being designed as a military base or for military use, and Cambodian officials deny that such is a possibility. Still, theories among military analysts in China regarding the role of commercial ports in extending China’s military presence overseas and the characteristics of infrastructure in the Pilot Zone keep speculation alive — and make it prudent to keep an eye on the project. Adding fuel to such concerns, a likely Chinese military-model aerial drone was reportedly found 7 kilometers outside of the Pilot Zone in January 2020.

Figure 4: Mentions of the Pilot Zone as tracked in the Recorded Future Platform (Source: Recorded Future)

Concerns regarding whether the Pilot Zone could be used by the Chinese military are informed by the value of dual-use commercial port and port-city infrastructure in supporting the logistics needs (replenishment, personnel and equipment transfer, etc.) of People’s Liberation Army Navy (PLAN) warships operating far from China’s shores. A major concept in this line of thinking is “strategic strongpoints” (战略支点), which authoritative sources refer to as locations that “provide support for overseas military operations or act as a forward base for deploying military forces overseas”. Researchers affiliated with the China Maritime Studies Institute find that strategic strongpoints are often marked by Chinese-led port projects involving commercial and infrastructure projects with “dual-use functions that can enable both economic and military activities”. Such dual-use strongpoints are situated in strategic locations, such as along sea lines of communication or near maritime chokepoints. An assessment in the Massachusetts Institute of Technology’s International Security journal asserts that “commercial port facilities enable considerable military logistics and intelligence capabilities in peacetime”, though their utility in wartime is uncertain.

Not all Chinese-led commercial or infrastructure projects are strategic strongpoints. Given the Pilot Zone’s current stage and state of development, it is unlikely to support PLAN operations in the short term. However, the Pilot Zone’s characteristics and long development timeline mean it could evolve to meet the logistics of Chinese naval operations in Southeast Asia, such as around the Malacca Strait and into the Indian Ocean. Analysis highlighted by C4ADS’ report from China-based Journal of International Security Studies (国际安全研究), described a “first civilian, later military” (先民后军) approach to “make [Chinese-owned] ports gradually possess the capability for offering logistical support to Chinese vessels and become China’s strategic [strongpoints] in Southeast Asia to create an advantageous external environment for China’s rise”. Such an approach is seen in the multipurpose port and related infrastructure in Gwadar, Pakistan, which are being developed as part of the BRI’s China-Pakistan Economic Corridor and are viewed by Chinese analysts as suited for evolution into a strategic strongpoint. Importantly, the Pilot Zone does not need to develop into a military base in the traditional sense to be useful for expanding the geographic scope of PLAN operations. Commercial ports can and have functioned as “‘pit stops’ to provide basic services such as refueling, provisioning, electrical power, and waste disposal for PLAN surface vessels”.

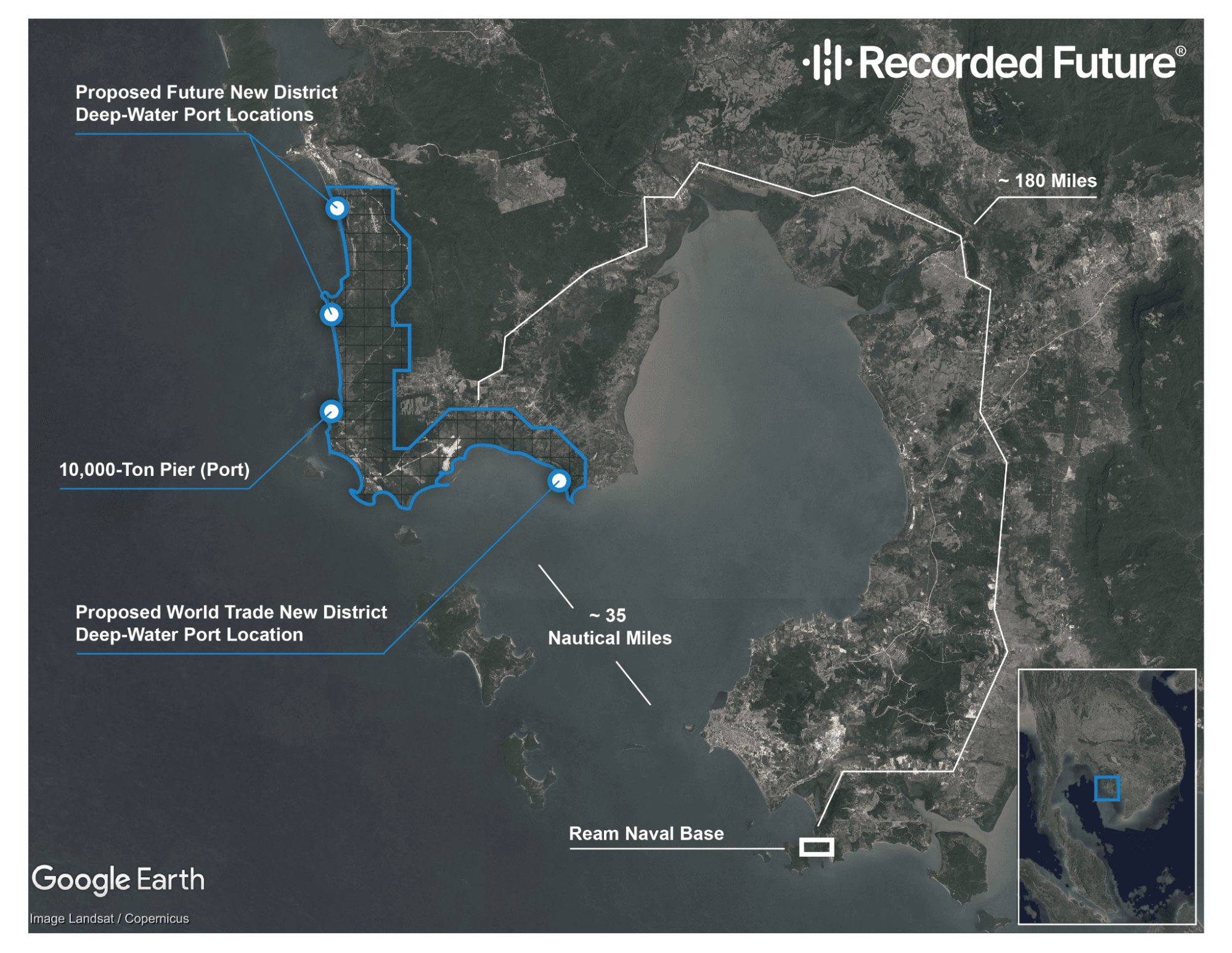

Figure 5: The Pilot Zone in relation to Ream Naval Base with proposed and actual port positions. The outline of the Pilot Zone is based on official marketing materials but is not authoritative (Source: Google Earth, December 2020; Created by Insikt Group)

Highlighting China’s likely assessment that Cambodia’s geographic position has strategic value, in June 2022 the Washington Post reported that China is building a “naval facility for its exclusive use” at Ream Naval Base in Preah Sihanouk province. The Pilot Zone is located roughly 35 nautical miles by sea and 180 miles by land from Ream Naval Base. When PLAN ships call at foreign ports, Chinese diplomatic missions and Chinese enterprises mobilize to provide logistical support. While it is most likely that Chinese enterprises located in Sihanoukville would be enrolled to provide such support, it is also plausible that some general supply and equipment warehousing could occur in the Pilot Zone even if PLAN vessels call at Ream, or that companies from the zone could mobilize to provide support. Chinese military personnel have also noted the role that commercial ports can play in accessing “rest and entertainment… and medical treatment”, and the Pilot Zone will ultimately provide options for this type of activity regardless of where PLAN ships dock (if the zone’s development continues according to plan).

The Pilot Zone’s airport and ports are also large enough to support Chinese military assets, fueling concerns. Foreign analysts have observed the Pilot Zone’s airport runway “is about 3,400 meters long, which is larger than the international airport in Phnom Penh and could accommodate any plane in the Chinese air force”. In fact, this is longer than Sihanouk International Airport’s runway and those of China’s dual-use military airfields on Woody Island and on Fiery Cross Reef in the South China Sea, as some observers have pointed out. Yet others stress this length is “not uncommon at airports that will be able to accommodate airliners, especially in an area of the world that experiences high temperatures year-round”. There are no other indications the airport is designed for military use.

Researchers further assessed in 2016 that a 10,000-ton pier (port) within the Pilot Zone would be large enough to host Chinese frigates and destroyers. At approximately 207 meters in length, the dock, which sits in 11-meter deep waters, could likely service 1 such vessel at a time based on the 2019-2020 People’s Liberation Army Navy (PLAN) Forces Recognition and Identification Guide produced by the US Navy’s Office of Naval Intelligence. As discussed below, however, the Pilot Zone is now envisioned to include 2 additional deep-water ports. Outside of the tourist areas, most of the Pilot Zone is still at the conceptual stage and there are conflicting reports about the specifications of these other 2 ports. Some sources claim there will be 2 additional 10,000-ton ports, others point to a 100,000-ton general port (10万吨综合性港口), and some non-company materials claim (without citation) that 1 of the additional ports will be a 2,000-ton port. In any case, it is likely that at least 1 of the additional ports will increase the amount of space that could theoretically be used by PLAN ships.

The Project Continues

In spite of US sanctions and speculation regarding its potential for military-use, the Pilot Zone has continued to develop since 2017. Basic infrastructure has expanded, new developments within the zone have been approved and begun construction, and the international airport inches closer to its grand opening. This work is now likely spearheaded by a new firm in the UDG family: Coastal City Development Group Co. (CCDG; 七星海城市发展集团有限公司; ខូសថល ស៊ីធី ឌីវេឡុបម៉ិន គ្រុប ឯ.ក). This company initially formed under a different name just after C4ADS published its report in early 2018 but adopted the CCDG name after UDG Cambodia was sanctioned.

In March 2022, the China-based Global Times tabloid reported that CCDG is now the “project developer” of the Pilot Zone on behalf of “Chinese developer Union Development Group”. Global Times does not specify UDG Tianjin or UDG Cambodia. Cambodian corporate records show that CCDG was initially established as Union City Development Group Co. Ltd. (យូញៀន ស៊ីធី ឌីវេឡុបម៉ិន គ្រុប ឯ.ក) in July 2018. Insikt Group cannot say when plans to establish this company were formed, but its creation occurred several months after C4ADS’ report was published, which likely stimulated additional negative attention directed toward the Pilot Zone amid ongoing coverage of the longstanding land disputes.

In December 2020, just months after US sanctions were placed on UDG Cambodia, Union City Development in Cambodia changed its name to CCDG. The new identity distances this new member of the UDG family from the “Union” brand, though only in name. CCDG is registered as a foreign Chinese company according to the records of Cambodia’s Ministry of Land Management, Urban Planning and Construction. Although it is a separate commercial entity, CCDG is almost certainly closely linked to UDG Cambodia and UDG Tianjin. With CCDG’s creation, the primary tourism-oriented development area within the Pilot Zone is now called “Coastal City”, rather than “Dara Sakor”. This can be seen in the logos on UDG Cambodia’s website (see Figure 7). This Coastal City logo also appears on CCDG’s website. Highlighting the link between this CCDG and UDG Tianjin, the latter changed its name to Tianjin Union City Development Group Co. (天津优联城市发展集团有限公司) in February 2022 (which is highly similar to CCDG’s original name).

Figure 6: CCDG corporate registration record showing name change in December 2020 (Source: Cambodian Ministry of Commerce, Department of Business Registration)

Figure 7: The logo on UDG Cambodia’s website in 2018 (left) as compared to the logo in 2022 (right) (Source: UDG Cambodia 2018; UDG Cambodia 2022)

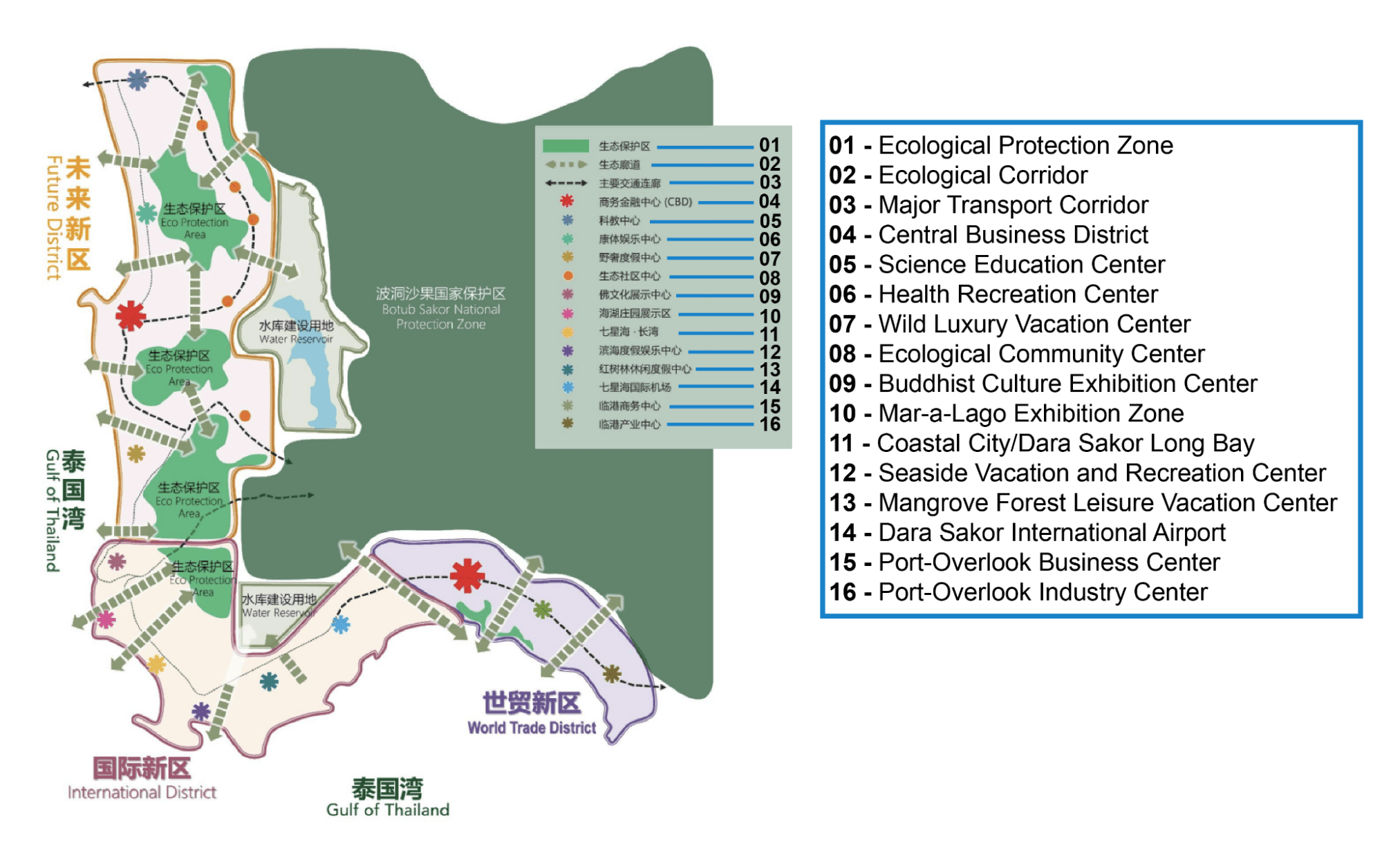

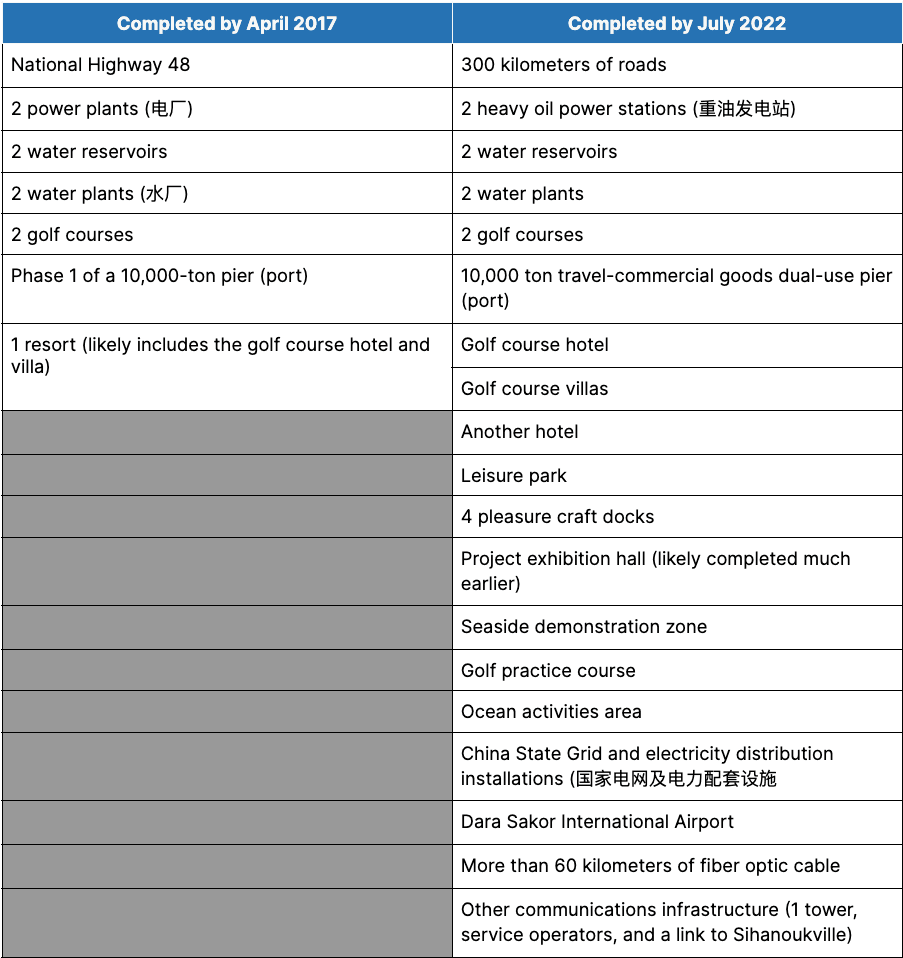

The overall plan for developing the Pilot Zone is largely the same as it was several years ago, but updated marketing materials use new names for some sub-projects in the Pilot Zone and provide additional details. The overall plan for the Pilot Zone now includes 3 primary divisions as listed below and shown in Figure 8. Each of these districts will be further subdivided into specialized zones and specific projects as depicted in earlier materials. In addition to the 10,000-ton pier (port) for cruise liners and commercial goods described in C4ADS’s report, current plans further include a deep-water port in both Coastal City Future New District and Coastal City World Trade New District.

Marketing materials downloaded from CCDG’s website show that current plans for the Pilot Zone also emphasize “Smart City” features enabled by information technology to provide security for people, property, and technology. They also show that medical and wellness facilities, including multiple hospitals (the largest having 500 to 800 beds), spa services and yoga providers, and access to Chinese traditional medicine; and education facilities, including a vocational school and international school, remain part of the zone’s vision. At least 1 marketing image, hosted on a realty website, suggests the Coastal City World Trade New District will include a “Permanent Site for [the] ASEAN Forum”. It is important to note that while UDG Cambodia owns the lease and CCDG is now a major, perhaps leading, contributor in developing the Pilot Zone, many other companies are also, or will be, involved as partners and investors. The future commercial ports could be operated by a company other than UDG Cambodia or CCDG.

Figure 8: Overall plan for the Pilot Zone from a CCDG marketing booklet published in 2022. Translations by Insikt Group (Source: CCDG).

Figure 9: Undated Pilot Zone area detail from CCDG, edited to accommodate translations by Insikt Group (Source: CCDG)

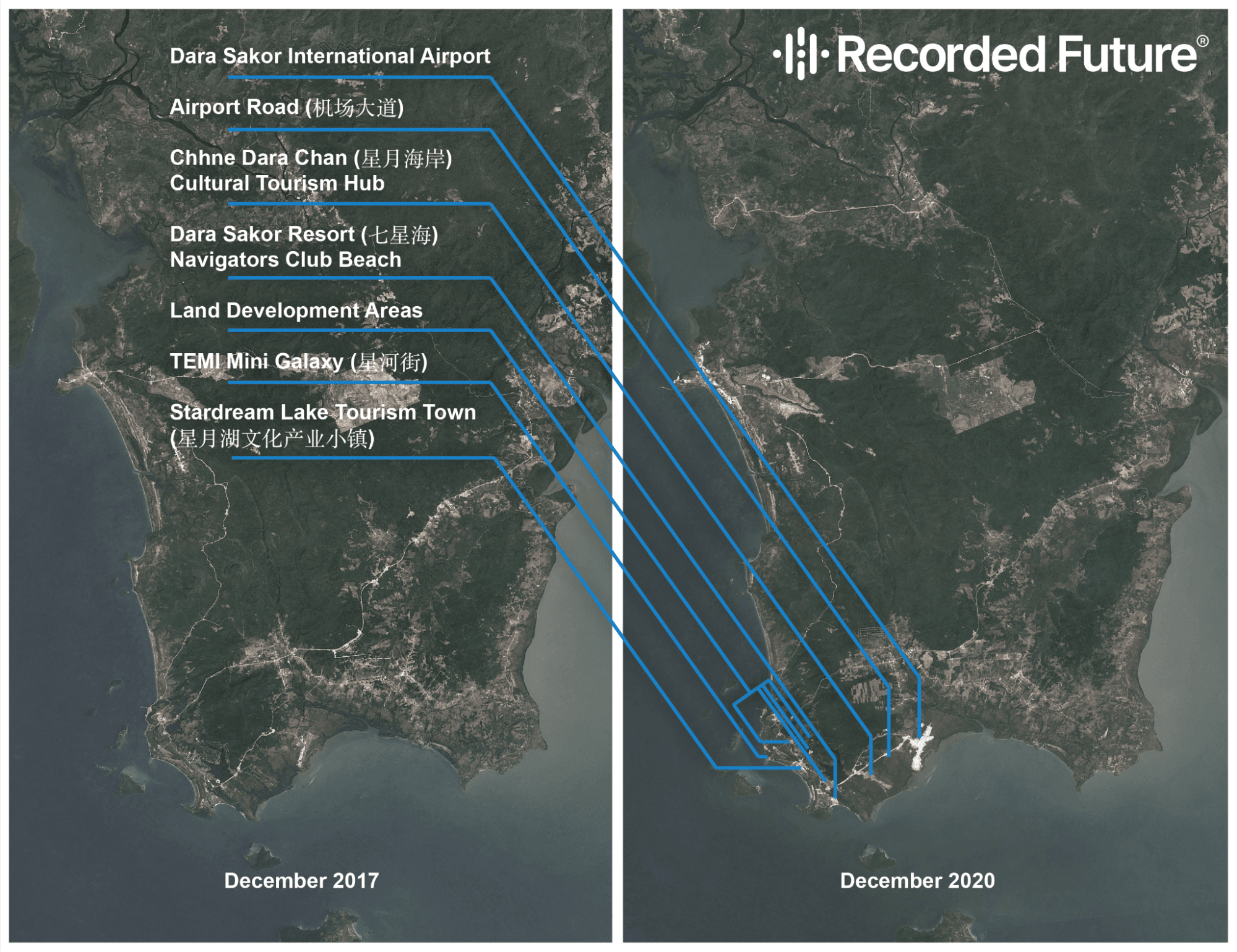

Comparing the content of CCDG’s website, Google Earth satellite imagery from late 2020, and mid-2022 satellite imagery acquired through SkyWatch with C4ADS’ April 2018 report, satellite imagery from late 2017, and other sources indicates that construction and development of the Pilot Zone is continuing (see Figure 10). Aside from the airport’s construction, focus was very likely on establishing power and telecommunications infrastructure as well as expanding the tourism projects of the Pilot Zone (see Figure 10 and Figure 11).

Figure 10: Areas of development within the the Pilot Zone in December 2017 and December 2020 (Source: Google Earth, December 2017, December 2020; Created by Insikt Group)

Figure 11: Comparison of reported completed Pilot Zone development in 2017 and 2022 (Source: C4ADS; CCDG [1, 2]; UDG; Google Earth)

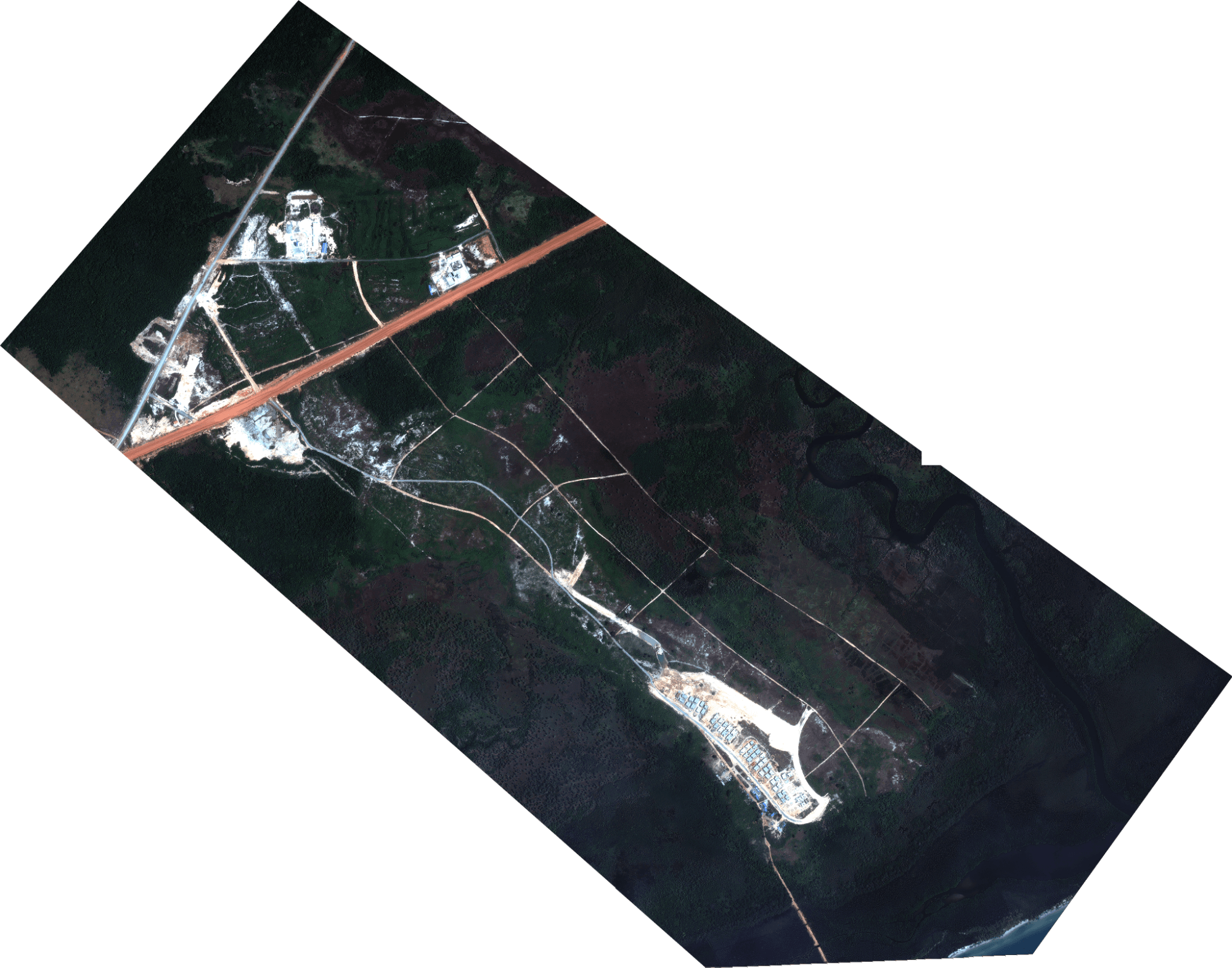

Since the September 2020 sanctions, work on the Pilot Zone has advanced in several areas. For example, the “Tourism, Ecological, Marine and International (Temi) tourism city development project” (also known as “TEMI Mini Galaxy”), which is reportedly valued at more than $500 million USD, has seen significant new construction based on satellite imagery from December 2020 and July 2022 (see Figure 12). The land area around the Chhne Dara Chan cultural tourism hub project has also undergone significant development (see Figure 13). The airport is also now more complete than it was at the time the US imposed sanctions (see Figure 14).

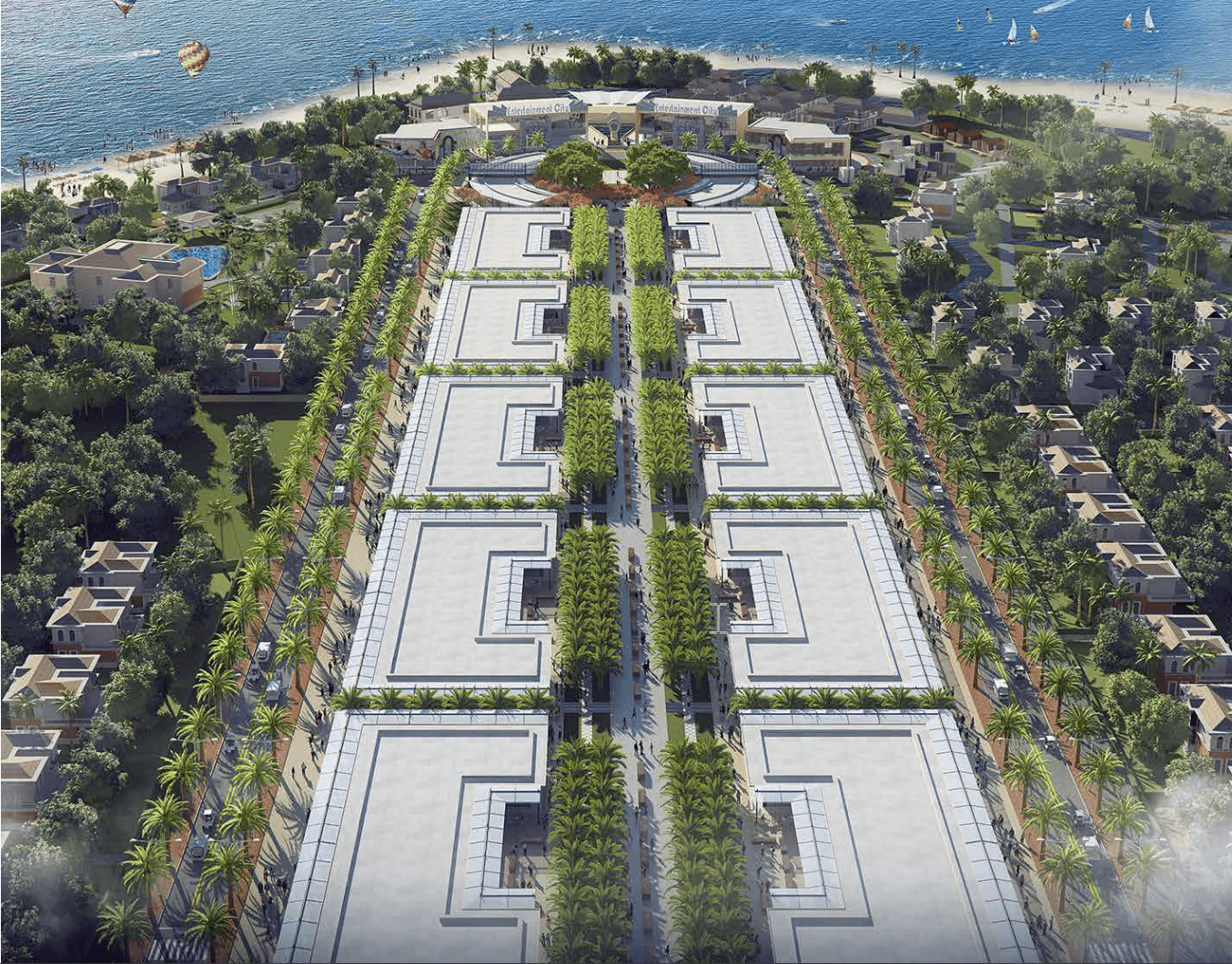

Figure 12: Artistic rendering of the future TEMI Mini Galaxy (top), development in December 2020 (left), and development in July 2022 (right) (Sources: CCDG; Google Earth, December 2020; Pleiades 0.5m, courtesy of SkyWatch)

Figure 12: Artistic rendering of the future TEMI Mini Galaxy (top), development in December 2020 (left), and development in July 2022 (right) (Sources: CCDG; Google Earth, December 2020; Pleiades 0.5m, courtesy of SkyWatch)

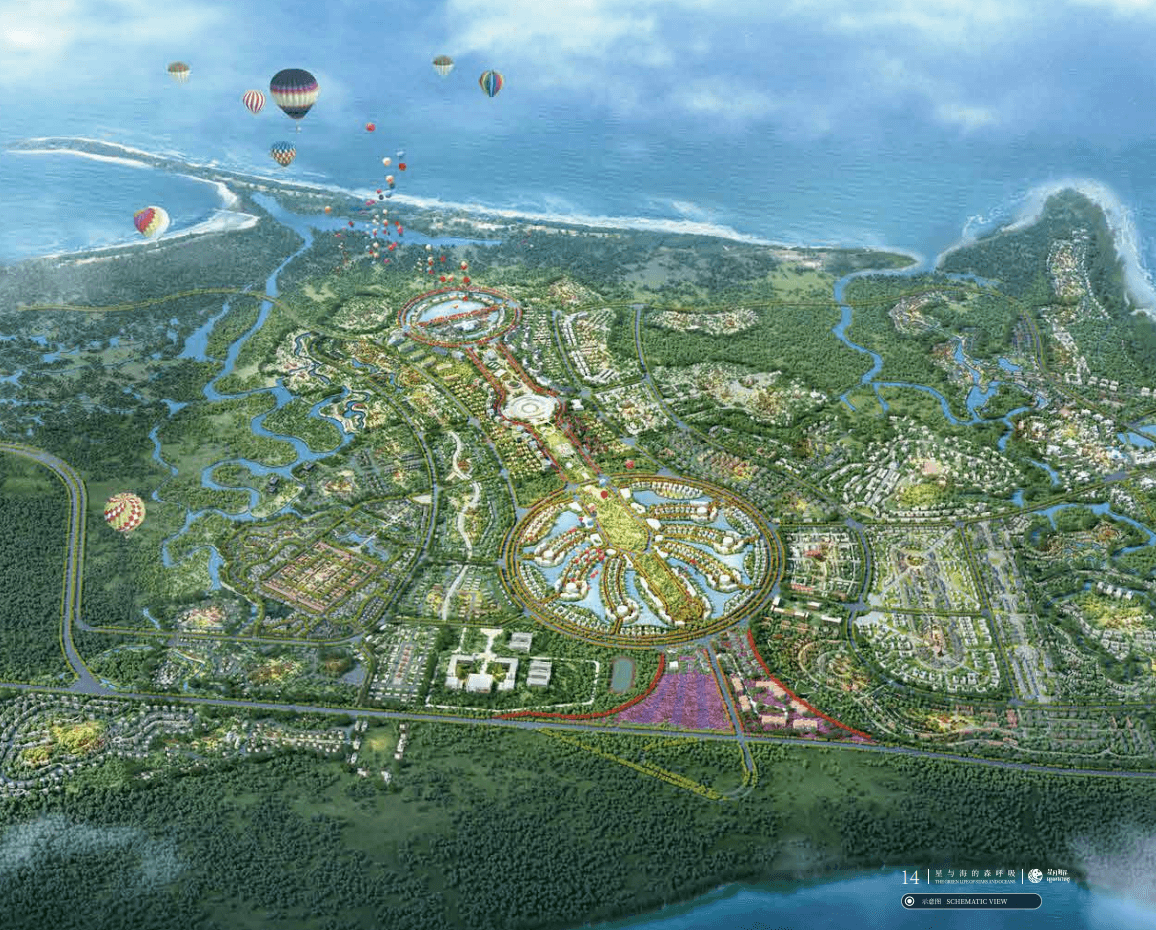

Figure 13: Artistic rendering of the future Chhne Dara Chan (top), development from December 2020 (left), and development as of February 2022 (right) (Sources: CCDG; Google Earth, December 2020; Pleiades 0.5m, courtesy of SkyWatch)

Figure 14: Dara Sakor International Airport in December 2020 (left) and May 2022 (Sources: Google Earth, December 2020; Planet SkySat 0.5m, courtesy of SkyWatch)

Other aspects of development are also moving forward despite sanctions. Examples include:

- In late November 2020, representatives of CCDG promoted investment opportunities related to the Pilot Zone and Coastal City Tourist Resort (七星海旅游度假特区) at the 17th China-ASEAN Expo under the company’s original name (Union City Development Group).

- In January and April 2021, CCDG signed at least 3 cooperative agreements with universities and vocational colleges in China pursuant to education and cultural exchange projects in the zone.

- In March 2021, CCDG met with China Construction Sixth Engineering Division Corporation (中国建筑第六工程局有限公司) and export credit insurer Sinosure (中国出口信用保险公司); the 3 discussed development of the Pilot Zone’s airport, ports, and industry parks (产业园), as well as project financing.

- In March 2021, CCDG signed a letter of intent for strategic cooperation with China-Africa TEDA Investment Co. Ltd. (中非泰达投资股份有限公司) to develop industry real estate in the Pilot Zone.

- In April 2022, Dara Sakor International Airport passed flight verification of its communications, navigation, and lighting equipment. Reports from November 2021 asserted the airport would open to commercial operations in mid-2022, but this schedule has been delayed.

- On June 7, 2022, CCDG began inviting investors for an unspecified “business street” (商业街).

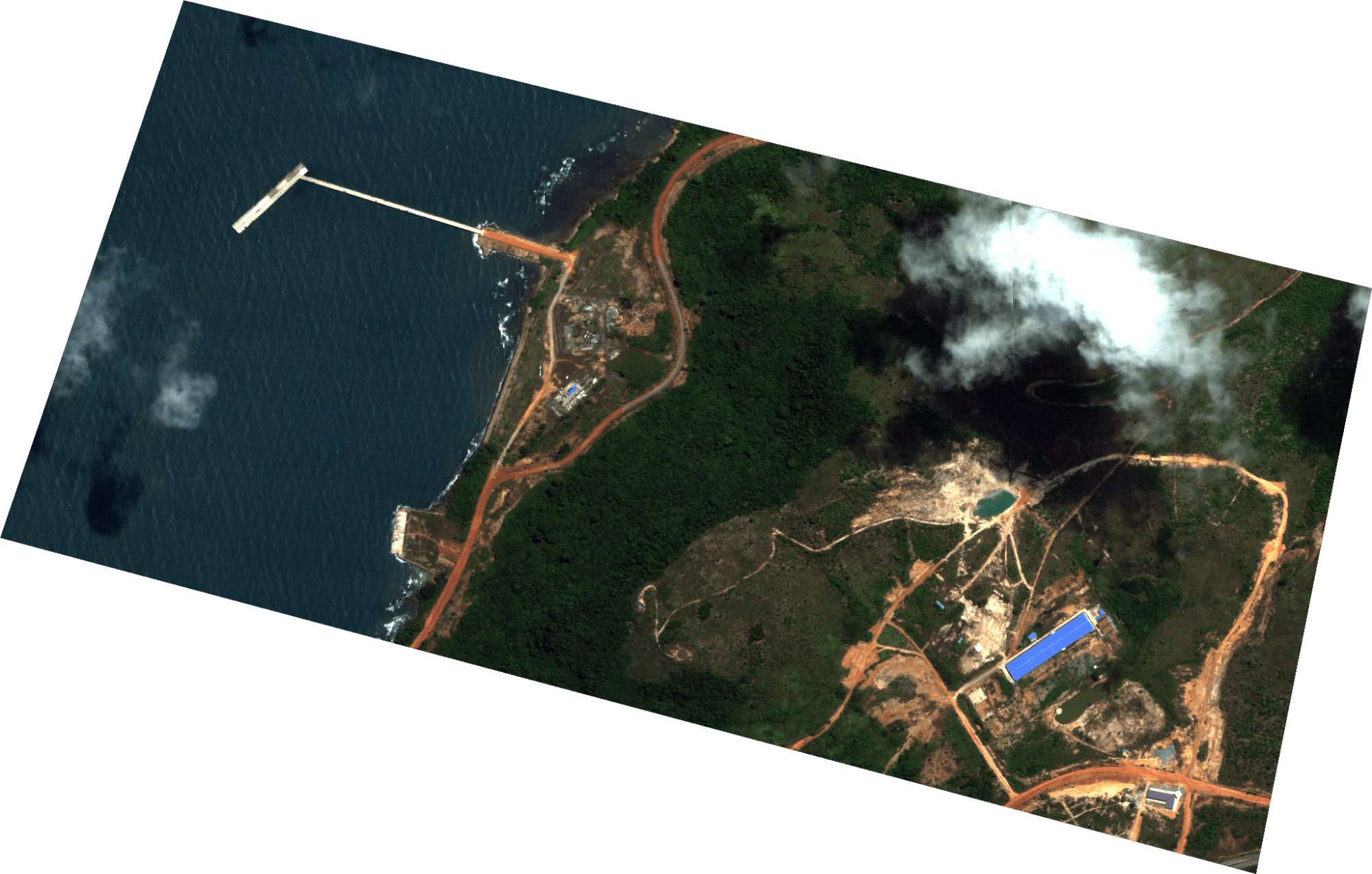

However, one aspect of the Pilot Zone does not appear to have progressed: port construction. CCDG’s website lists a “10,000-ton travel-commercial goods dual-use pier [port]” as completed, but the appearance of this port in satellite imagery from mid-2022 is largely the same as its appearance in late 2017 and late 2020. The pier itself looks to be in better condition than previous years, possibly more complete, but the shore area remains underdeveloped. Some parts of the website reference a 20,000-ton cruise liner port (邮轮港口) as also having been completed, but this is likely a misrepresentation of the aforementioned 10,000-ton pier (port). Insikt Group did not identify new construction on the 2 additional deep-water ports now planned for the zone.

Figure 15: The 10,000-ton pier (port) in January 2017 (top), July 2020 (left), and May 2022 (Sources: Google Earth, January 2017, July 2020; Planet SkySat 0.5m, courtesy of SkyWatch)

Outlook

When discussing China’s military power projection, many news reports and commentaries focus on the concept of a “military base”. This evokes images of China building a series of permanent installations with hardened facilities similar to those of the US. Although there are differing assessments as to whether China is seeking or will, under certain conditions, seek to establish formal military bases beyond its current logistics base in Djibouti, China is very likely to continue employing a “pit stop” model that uses commercial port facilities to support the military logistics needs of operations other than war. The US government sanctioned UDG Cambodia in 2020 in part because it was concerned the Pilot Zone could host Chinese military assets. However, the sanctions have failed to stop progress in the zone. While not all Chinese port and port-city projects will become strategic strongpoints or otherwise be used for military purposes, the Pilot Zone’s location and envisioned — or actual — features point to this possibility. As such, continued monitoring of progress and activities within the zone is warranted.

Related